Mastering Customer Acquisition Cost Calculation

Let's break down how to calculate your Customer Acquisition Cost (CAC). At its core, the formula is simple: you divide your total sales and marketing costs by the number of new customers you brought in over a set time. This single number is one of the most honest ways to see if your growth is actually profitable.

Why CAC Is Your Business's True North

Before you even think about opening a spreadsheet, let's get one thing straight. Your Customer Acquisition Cost isn't just another vanity metric—it's the pulse of your business's financial health. It tells the real, unfiltered story of how well your marketing is working. It reveals whether you're building a sustainable business or just spinning your wheels and spending money to look busy.

Think of it this way: CAC is the total investment you make to convince a single person to finally pull out their wallet and become a paying customer. So many creators and small business owners stumble right here. They only count their obvious ad spend, and that gives them a dangerously incomplete picture of reality.

The Hidden Costs That Inflate Your CAC

The true cost to win a customer runs much deeper than your ad budget. To get an accurate number, you have to be honest with yourself and account for every single expense that played a part in getting that new sale. These often-forgotten costs can completely change the math.

What kind of costs are we talking about?

- Software and Tools: That email marketing platform, your webinar software, the social media scheduler, your analytics tools—all those monthly subscriptions add up and support your acquisition efforts.

- Content Creation: The hours and money you pour into blog posts, videos, graphics, or podcast episodes are all marketing investments.

- Salaries and Contractor Fees: If you have a VA helping with marketing, a freelancer running your ads, or even just the value of your own time spent on sales, that's a direct cost.

- Commissions and Affiliate Payouts: Any money you pay out to partners or affiliates for sending customers your way is a direct part of your acquisition spending.

Ignoring these "hidden" costs gives you a falsely low CAC. This can trick you into scaling a business model that's actually leaking money. You might be celebrating a PLN 50 CAC when, in reality, it's closer to PLN 150. Trying to grow a business on bad data is a fast track to failure.

Your CAC isn’t just an expense to minimize; it's an investment to optimize. Knowing the true cost to acquire a customer is the first step toward making every sale a profitable one and building a brand that lasts.

Building a Foundation for Profitable Growth

Getting a handle on your complete CAC is the bedrock of smart decision-making. It impacts your pricing, helps you pick the right marketing channels, and ultimately decides if your business can survive long-term.

For example, when you know your true CAC, you can confidently price your online courses, memberships, or e-books to ensure you're actually making money on each sale. Zanfia offers creators maximum monetization flexibility by supporting one-time purchases, subscriptions, installment plans, and product bundles.

It also brings incredible clarity to which marketing channels are giving you a real return. You can finally compare the CAC from your Facebook ads to the CAC from your organic search traffic and see where your budget is actually working. This is a crucial piece of building effective digital marketing strategies for small business that deliver results without burning through your cash. When you treat CAC as a core metric, you stop spending on marketing and start investing in growth.

Gathering the Right Data for an Accurate CAC

Your Customer Acquisition Cost is only as good as the data you feed it. Before you even think about plugging numbers into a formula, you need to put on your detective hat and hunt down every single penny that goes into winning a new customer. The old saying holds true: garbage in, garbage out. If your inputs are fuzzy, your CAC will be a vanity metric, not a tool for growth.

So, where do you start? The best first step is to split your expenses into two main buckets: Marketing and Sales. This simple division immediately brings clarity to where your money is going.

Uncovering Your Total Marketing Costs

This is everything you spend to get eyeballs on your brand and pull people into your world. For a digital creator, this goes way beyond just running a few ads. It’s a complete inventory of every tool, person, and activity you use to attract potential buyers.

Think of it as a checklist:

- Ad Spend: The obvious one. This is your total outlay on platforms like Meta (Facebook and Instagram), Google Ads, TikTok, or whatever channels you're using.

- Content Creation: Did you pay a video editor for your YouTube channel? Hire a designer for your thumbnails? Those are direct marketing costs. And don't forget to value your own time if you’re a one-person show.

- Software Subscriptions: This bucket is often a lot bigger than people expect. We're talking about your email service (like ConvertKit), your social media scheduler, any SEO tools, and your analytics software. Zanfia eliminates the need for costly external video services like Vimeo or Wistia by offering advanced native video hosting, directly reducing this expense.

- Team & Freelancers: If you have a VA managing your community or a marketing contractor running campaigns, a slice of their salary or their entire fee is a customer acquisition cost.

It’s one thing to spend the money, but it's another to know if it's working. You can get a better handle on this by learning how to measure your content marketing ROI in a way that actually connects your efforts to revenue.

Tallying Up Your Sales Costs

These are the costs directly tied to closing the deal—turning an interested lead into a paying customer. Sometimes these overlap a bit with marketing, but I find it helpful to think of them as the "last mile" expenses.

For most creators, these costs look like this:

- Sales Team & Commissions: If you have someone running sales calls or you pay out commissions, that compensation is a sales cost.

- Affiliate Payouts: This is a big one. The commissions you pay to your partners for sending you customers are a direct cost of acquiring those specific customers.

- Payment Processor Fees: While Zanfia proudly charges 0% platform fees, you still have the standard transaction fees from payment gateways like Stripe or PayU. These are a non-negotiable cost of doing business and belong in your CAC.

- Sales Software: This could be a CRM, a webinar platform you use for live sales events, or booking software for discovery calls.

This diagram really drives home how the marketing spend you see on the surface combines with those less obvious costs to form your true CAC.

The real insight here is that ignoring those "hidden costs" gives you a dangerously optimistic and incomplete view of your business's financial health. You must account for them.

To help you get started, here’s a quick checklist of the most common costs I see creators overlook when they first calculate their CAC.

Essential Costs for Your CAC Calculation Checklist

This table breaks down the common sales and marketing expenses digital creators must track for an accurate CAC formula.

| Cost Category | Specific Examples for Creators | Why It Matters |

|---|---|---|

| Direct Ad Spend | Meta Ads (FB/IG), Google/YouTube Ads, TikTok Ads, Promoted Pins | This is the most visible cost but often just the tip of the iceberg. |

| Content Creation | Freelance video editors, graphic designers, copywriters, stock photo/video subscriptions | High-quality content isn't free. These costs are directly tied to attracting your audience. |

| Marketing Software | Email (ConvertKit), SEO (Ahrefs), Analytics (Zanfia), Social Scheduling (Buffer) | Your tech stack is a significant, recurring expense that supports all acquisition efforts. |

| Team/Salaries | Portion of a VA's time, marketing manager's salary, contractor fees | The people powering your marketing machine are a major part of the acquisition cost. |

| Sales Commissions | Affiliate payouts, commissions for a sales rep closing high-ticket deals | These costs scale directly with new customers and must be included for an accurate per-customer cost. |

| Sales Software | CRM, booking calendars (Calendly), webinar platforms (for sales events) | These tools facilitate the final conversion and are a direct cost of closing a sale. |

| Transaction Fees | Stripe, PayU, or other payment processor fees | While small per transaction, these add up and represent the final cost of securing a payment. |

Tracking these meticulously is the difference between a rough guess and a number you can actually use to make smart business decisions.

Accurate CAC calculation hinges on properly attributing which marketing and sales efforts led to a customer. Delve deeper into understanding attribution models to ensure your data inputs are sound.

Defining a Consistent Time Period

The final piece of this puzzle is simple but crucial: consistency. You have to measure all of these costs—and the new customers you acquired—over the exact same time period.

Whether you calculate CAC monthly, quarterly, or annually, you have to stick with it. This consistency is what lets you spot trends, see if that new ad campaign is actually paying off, and compare apples to apples over time.

For most creators and small businesses, a monthly or quarterly calculation hits the sweet spot. It’s frequent enough to catch problems before they spiral but not so often that you're driven crazy by tiny, meaningless fluctuations. Pick your period, gather the data, and you’re ready to actually run the numbers.

The Simple CAC Formula: A Real-World Walkthrough

Once you’ve gathered your numbers, it's time to run the first, most essential CAC calculation. Don't worry, the basic formula is surprisingly straightforward. It cuts through the noise and gives you a clean baseline for how efficiently your marketing dollars are working.

Here’s the classic formula:

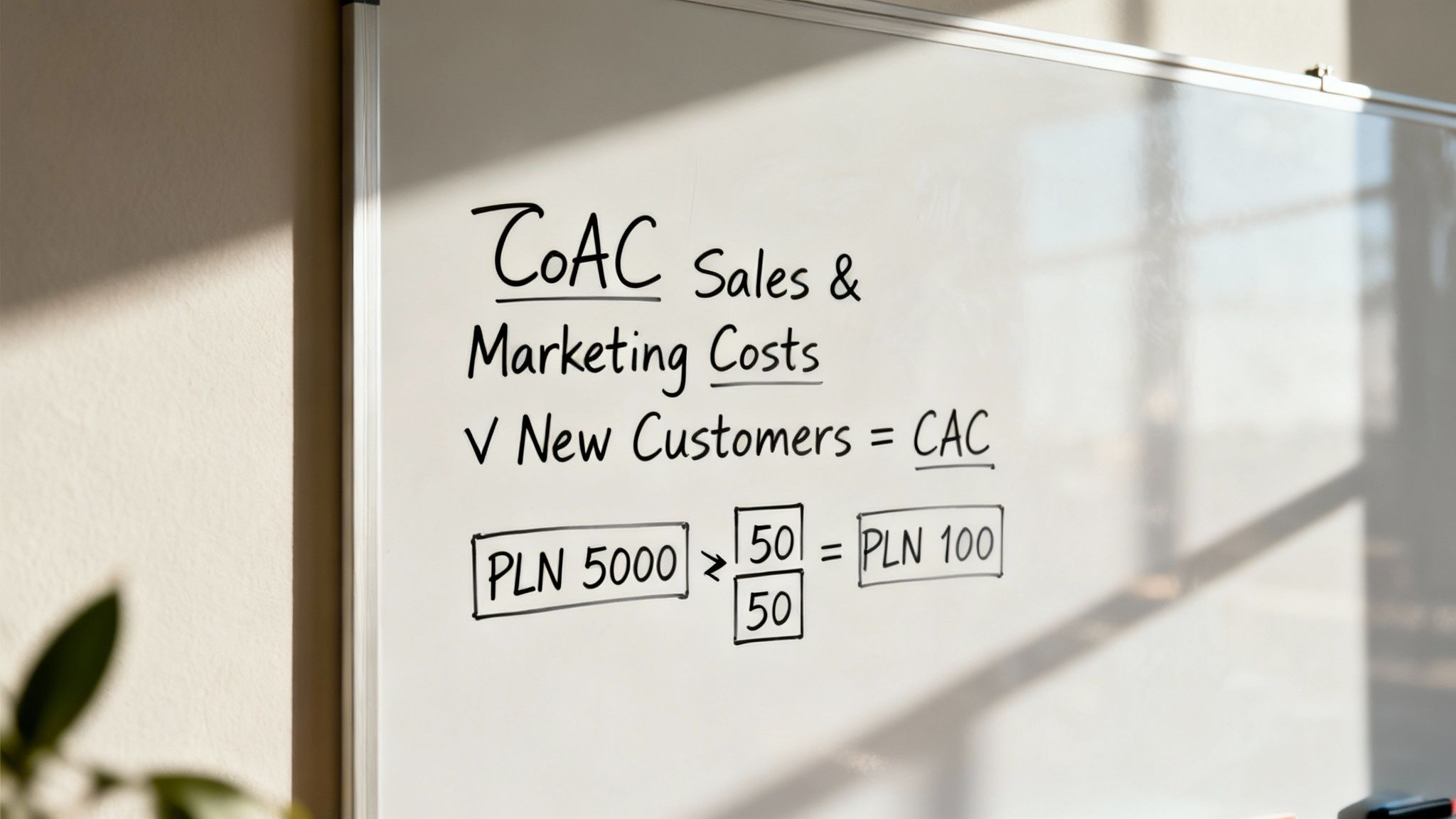

Total Sales & Marketing Costs ÷ Number of New Customers Acquired = Customer Acquisition Cost

This simple equation answers a huge question: "For all the time and money we put into sales and marketing last month, what did it cost us, on average, to land one brand new customer?" It's your starting line.

Putting It Into Practice: A Digital Creator Example

Let's make this tangible with a scenario any online creator or coach will recognize. Say you sell a signature online course and want to figure out your CAC for last month.

First, you’ll need to add up all your marketing and sales expenses for that period.

- Meta Ads (Facebook & Instagram): PLN 3,000

- Marketing Software (Email, Scheduler): PLN 500

- Virtual Assistant (for marketing tasks): PLN 1,500

That brings your Total Sales & Marketing Costs to PLN 5,000.

Next, you dive into your sales records for the same month and find you enrolled 50 brand-new students.

Now, just plug those numbers into the formula:

PLN 5,000 (Total Costs) ÷ 50 (New Customers) = PLN 100 (CAC)

Your Customer Acquisition Cost for the month was PLN 100. In other words, you spent an average of PLN 100 to bring each new student into your program. This single number is the first step toward real financial clarity. For a more detailed look at the different ways to approach this, check out this complete guide to customer acquisition cost calculation.

Why You Must Only Count New Customers

Here’s a common tripwire I see people hit all the time: they lump new and returning customers together. This is a critical mistake. The "Acquisition" in CAC specifically refers to winning over someone for the very first time.

If you include repeat buyers in your total, you’ll artificially deflate your CAC and get a false sense of security about your marketing. A returning customer was already won; their latest purchase is a win for your retention strategy, not your acquisition efforts.

Key Takeaway: To get an accurate CAC, you absolutely have to segment your customer data. Only count the people who made their first-ever purchase with you during the period you're measuring.

This is where a platform like Zanfia really helps. Its built-in analytics give you deep visibility at every stage of the funnel, helping you easily filter sales data and separate first-time buyers from loyal repeat customers. Clean data is everything for a reliable CAC.

Looking Beyond the Obvious Costs

The formula is simple, but getting the inputs right requires a bit of diligence. Your "costs" aren't just your ad spend. A truly accurate CAC includes everything that contributed to that acquisition. Think marketing team salaries, software subscriptions, content creation expenses, and even the cost of any introductory discounts you offered.

This comprehensive view is vital. For creators in the Polish market, this also means accounting for local factors and ensuring your payment systems are optimized with gateways like PayU, Przelewy24, and BLIK to maximize conversions, a feature Zanfia handles seamlessly.

Knowing your CAC is PLN 100 is a great start, but what really matters is what you do with that information. Is PLN 100 a good number? That completely depends on what you're selling. If your course is priced at PLN 99, you're losing money on every sale. But if it costs PLN 999, you've built a fantastic, scalable business.

The most direct way to improve this number is to make your sales funnel more efficient. If you can turn more visitors into buyers without increasing your ad spend, your CAC will naturally go down. This is all about constant testing and tweaking—a process at the heart of these proven conversion rate optimization strategies. This simple calculation is your launchpad for that entire journey.

What Your CAC Number Is Actually Telling You

Calculating your Customer Acquisition Cost is a huge step toward financial clarity, but the number itself is only half the story. A CAC of PLN 100 might be a fantastic result for one business and a complete disaster for another.

The real insight comes when you compare this cost to what a customer is actually worth to you over time. This is where your CAC meets its crucial partner metric: Customer Lifetime Value (LTV).

Simply put, LTV is the total revenue you can expect from a single customer throughout their entire relationship with your business. By pairing these two metrics, you can finally answer the most important question for sustainable growth: "Is my customer acquisition strategy profitable in the long run?"

The Magic Number for Sustainable Growth: The LTV to CAC Ratio

The relationship between what you spend and what you earn is captured in the LTV to CAC ratio. This isn't just an abstract business school concept; it's a practical health check for your entire business model. It tells you if you've built an engine that can grow, or one that's destined to run out of fuel.

Across many industries, a healthy benchmark for this ratio is 3:1.

This means for every dollar you spend to acquire a new customer, you should expect to get at least three dollars back in lifetime revenue. If your CAC is PLN 100, your LTV should ideally be at least PLN 300 for your business to be considered healthy and scalable.

This ratio gives you a clear framework for judging your results. It transforms your CAC from a simple expense into a strategic investment, giving you a target to aim for with all your sales and marketing efforts. It’s also the first step toward understanding how to forecast revenue and plan for future growth. If you want a deeper understanding of this crucial metric, check out our complete guide on the customer lifetime value calculation.

Decoding Your LTV to CAC Ratio: What It Means

Your specific ratio is a powerful signal that tells you what to do next. It’s not about hitting some perfect number but understanding the story behind your result.

Here's a quick guide to what your ratio is telling you:

- Below 1:1: This is an urgent warning sign. You're spending more to acquire customers than they are worth to you. Every new sale is actively losing you money, and this model is completely unsustainable.

- Around 1:1: You're essentially breaking even on each new customer. While you aren't losing money on acquisition, you have no profit margin to cover all your other business overheads, like product development or operational costs.

- Between 1:1 and 3:1: You're on the right track but still have room to optimize. Your business is profitable on a per-customer basis, but you might be leaving money on the table through inefficient ad spend, low conversion rates, or a product that doesn't encourage repeat purchases.

- 3:1 or higher: Congratulations, you've hit the sweet spot for sustainable growth. Your sales and marketing engine is efficient, and you're generating a healthy return on your investment.

- Much higher than 3:1 (e.g., 5:1 or more): This might seem like a dream scenario, but it can sometimes indicate you're under-investing in marketing. You might be missing out on opportunities to acquire even more profitable customers and could be growing faster by strategically increasing your acquisition spend.

It’s also crucial to remember that acquisition costs vary wildly by industry. For e-commerce businesses, the LTV to CAC relationship is critical, with experts widely recommending that 3:1 ratio. Average CACs can range from around $61 for beauty products to $76 for consumer electronics and even $91 for jewelry, illustrating how important it is to know your own numbers. Dive into these in-depth industry reports on customer acquisition costs to see where you stand.

Understanding your LTV to CAC ratio moves you beyond just calculating costs and into the realm of strategic business management. It provides the context you need to set realistic goals, allocate your budget intelligently, and build a truly resilient online business.

Practical Ways to Lower Your Customer Acquisition Cost

Okay, so you've done the math and calculated your Customer Acquisition Cost. That's the diagnostic. Now, let's talk about the treatment. The goal here isn't just about slashing your budget; it's about spending smarter and making every złoty you invest in marketing pull its weight. This means going beyond simple ad tweaks and digging into the high-impact strategies that fuel real, sustainable growth.

True optimization starts when you look at the entire customer journey, from that very first click all the way to the final sale. You'd be surprised how a small improvement in your conversion rate can have a much bigger impact on your CAC than just throwing more money at your ad spend.

Sharpen Your Landing Page and Value Proposition

Your landing page is the moment of truth. It's where curious prospects either become paying customers or click away forever. Any friction here—confusion, a weak offer, a clunky design—will send your acquisition costs through the roof.

You have seconds to make your value proposition crystal clear. Does your headline grab your ideal customer and speak directly to their biggest problem? Is your call-to-action (CTA) button unmissable and compelling? Think about it: a page that converts at 4% instead of 2% literally cuts your CAC in half. And you didn't have to spend a single extra złoty on ads to get there.

Build an Engaged Community for Organic Growth

Paid ads are great for getting customers today. But an engaged community? That gets you customers for life—and many of them for free.

When you create a genuine space where people feel connected and valued, they transform into your most powerful marketing channel. They're the ones who will refer friends, share your content without being asked, and provide the kind of social proof money can't buy. This is a fundamental shift from a transactional relationship to a relational one. Instead of constantly paying to find new people, you're nurturing an asset that generates its own momentum.

This is exactly why platforms like Zanfia are built to integrate community spaces directly with courses and products. Unlike platforms that push audiences to external tools like Discord, Zanfia keeps everything unified under the creator’s brand—dramatically boosting engagement, lifetime value, and member retention.

A strong community turns customers into advocates. Their referrals and testimonials are some of the most effective—and cost-efficient—marketing you will ever have, directly reducing your reliance on paid acquisition channels.

Increase Customer Lifetime Value to Make CAC Sustainable

Sometimes, the smartest way to fix a high CAC isn't to lower the cost itself but to increase what each customer is worth to you. When you boost your Customer Lifetime Value (LTV), you can comfortably afford to spend more to acquire a customer and still come out highly profitable.

Here are a few proven ways I've seen this work wonders:

- Offer Upsells and Cross-sells: The moment someone buys your introductory course is the perfect time to offer them an advanced workshop or a one-on-one coaching package.

- Create Product Bundles: Package several related products together—maybe an e-book, a mini-course, and a template pack—into a single high-value offer. This instantly increases your average order value.

- Implement Tiered Subscriptions: For communities or memberships, create different access levels with increasing value. This gives your most engaged members a clear path to upgrade and invest more with you over time.

A higher LTV is a massive competitive advantage. It lets you outspend competitors who are only focused on that first sale.

Consolidate Your Tech Stack to Reduce Overhead

Those "hidden costs" from a dozen different software subscriptions can quietly inflate your CAC without you even realizing it. When you're juggling separate tools for your community, courses, email, and payments, you're not just creating complexity—you're racking up costs. Every one of those monthly fees is a direct marketing and sales expense that has to be factored into your customer acquisition cost calculation.

This is where a true all-in-one platform like Zanfia makes a direct impact. By consolidating your tools, you eliminate redundant subscriptions immediately. Zanfia’s native video hosting means you can ditch that separate Vimeo or Wistia subscription. Its integrated community, course, and e-commerce features mean you’re paying for one smart system, not five disconnected ones.

Better yet, Zanfia's powerful automations—like instantly granting course access or adding new buyers to a specific community channel—save creators 5–10+ hours per month. That's time you can pour back into creating amazing content instead of fighting with administrative tasks. Automating that post-purchase welcome sequence is crucial, and you can get more ideas by exploring drip campaign best practices to nurture those new customers from day one. This consolidation of tools and time directly lowers the "M" in your CAC formula, making your entire business more efficient and profitable.

Got Questions About Your CAC? Let's Unpack Them

Even with a solid formula, calculating your customer acquisition cost in the real world can get a little messy. You start plugging in numbers and suddenly, a bunch of questions pop up. Let's walk through some of the most common sticking points I see creators and entrepreneurs run into. Getting these details right is what turns a fuzzy metric into a powerful business lever.

Sorting out these nuances is how you sharpen your customer acquisition cost calculation from a rough guess into a tool you can actually use to make smart decisions.

How Do I Handle Free Trial Conversions?

This one trips up a lot of people, especially in the subscription world. Do you count the acquisition cost when someone signs up for a free trial, or when they actually pull out their credit card and become a paying customer?

The best approach here is to attribute the cost to the period when the payment actually happens. Think of it this way: a free trial signup is a great marketing win, but you haven't truly "acquired" a customer until revenue is generated. Tying your CAC directly to that first payment keeps your numbers clean and gives you a far more accurate view of your profitability.

How Often Should I Be Calculating CAC?

It's tempting to check your numbers constantly, but daily calculations are usually overkill. You'll end up making knee-jerk reactions to tiny, meaningless dips and spikes. On the flip side, waiting a whole year means you could be flying blind while a major problem goes unnoticed.

For most creators and small businesses, a monthly calculation is the sweet spot. It’s frequent enough to catch important trends—like how that new ad campaign is performing—without getting lost in the daily noise. A quarterly review is also a great idea for a more strategic, big-picture look, as it helps smooth out any weird fluctuations from a single month.

My CAC Is Sky-High. What Now?

Seeing a high CAC can feel like a gut punch, I get it. But it's not a reason to panic and kill your entire marketing budget. It’s a diagnostic tool.

An unexpectedly high CAC isn’t a failure; it’s a signal. It's your data telling you exactly where to focus your optimization efforts for the biggest impact on your bottom line.

Instead of panicking, it's time to play detective. Start by breaking things down.

- Look at your channels. Is one particular platform blowing up your average? Maybe your Google Ads are bringing in customers efficiently, but your Meta ads are struggling, which is pulling the whole average up.

- Analyze your funnel. Where are people dropping off? A landing page that isn't converting or a clunky checkout process can torpedo your CAC, even if your ads are great.

- Revisit your targeting. Are you absolutely sure you're talking to the right people? Pouring money into ads that reach an audience that doesn't care about your offer is the fastest way to burn cash.

A high CAC is just a starting point. It’s a bright, flashing arrow pointing you toward the exact spots in your business that need a little more attention.

Ready to stop juggling dozens of tools and start building a profitable online business with clarity and control? Zanfia combines your courses, community, and digital products into one seamless platform with 0% platform fees, powerful automations, and deep analytics to help you master your CAC. Discover how Zanfia can help you grow.